Digital Property

The Distributed Ledger Technology (DLT) behind trendy terms like crypto coins, blockchain, the metaverse, web3 and NFT’s enables real digital property. The digital realm consists of programmable computers, interconnected through the world wide web. By introducing property in the digital world it turns programmable and instantly, globally tradable (liquid). In a first phase, we will possess pure, natively digital objects, like for example digital coins, digital art or objects from video games. In a second phase, some physical objects will receive a digital representation, so that the possession of these physical objects turns programmable and liquid too.

Purple Daze #1, NFT photography from Vaughn Meadows

Scarcity can turn property valuable

We want to possess objects for several subjective and intersubjective reasons: collecting (e.g. stamps), social signaling (e.g. a Rolex), utility (e.g. a car), investing (e.g. stocks), personal meaning (e.g. an heirloom), … On the one hand, we deem possessing an object valuable if (a group of) other people deems its possession valuable (intersubjective reason). On the other hand, we consider possessing something meaningful, because of a personal connection with an object (subjective reason). Possessing something is not by definition valuable or meaningful. If everyone has a Rolex or you possess 1000 heirlooms, than this undermines the value and meaning of one Rolex or one heirloom. Both in case of intersubjective and subjective reasons, scarcity plays a role in providing value and meaning.

Programmable scarcity in the digital world

The digital realm seems to know little scarcity until now. Digital objects consists of a series of bits, which are easy to copy and save at different locations (right-click, save as). Still we can argue that we already possess digital objects in an inferior way, like for example emails and objects from video games.

We mostly make use of an email service, but in principle anyone can set up an SMTP server to send emails (Simple Mail Transfer Protocol). After the email is sent, the sender possesses it in the outbox and the receiver possesses a copy in the inbox. We can copy and send an email endlessly, until everyone received it. Therefore the question rises, if anyone can truly possess an email or if it has value at all, because scarcity is not provable.

The introduction of valuable digital property in the existing digital world leads to two important consequences: property becomes programmable and liquid. In addition to programming scarcity, we can in principle program all possible functionality surrounding digital property. Because DLT is built upon the infrastructure of the internet, we can send digital property instantaneously to the other side of the world, just like emails. Decentralized Finance (DeFi) is a popular, existing set of applications, illustrating the implications of digital property: a Belgian person can within seconds borrow digital money from an Australian person with a digital object as collateral. This doesn’t require trust in a third party (e.g. a bank) that facilitates and supervises the transaction. Only trust in a decentral, programmable and liquid platform suffices.

Embracing digital property will have several phases. First we will possess pure, natively digital objects. Often these objects will be a digital or internet alternative for objects from the non-digital world. Bitcoin is digital gold or cash of the internet. Non-Fungible Tokens (NFT’s) often represent art and collectibles, that we can digitally exhibit. It is important to note that these digital objects are not merely digital versions of non-digital objects. Bitcoin solves the transport issues gold and cash face and NFT’s guarantee an immutable provenance of collectibles. In a next phase, some physical objects will be digitally represented, like for example real estate, cars and all sorts of tickets. In the future, you can presumably buy within seconds a fraction of a self-driving taxi located in Bangkok and earn part of the profit after every passenger pays. In time digital and physical objects will enjoy programmability and liquidity.

Fidenza #313, generative art from Tyler Hobbs (property of punk6529)

Founder Cat #29, in-game object from Cryptokitties (property of punk6529)

Expanding web2 or embracing web3

Will we inevitably have true decentral digital property? Unfortunately not. Central instances like governments and companies have their reasons to enforce digital property through their own central databases to be in control. Governments instances will soon launch Central Bank Digital Currencies (CBDC’s). This opens new perspectives for focused monetary and budgetary policy. Governments or central banks can directly transfer money to citizens and determine on what they can spend it, for example on bread and not on beer. Companies like Meta, former Facebook, aim to create immersive digital worlds and levy high costs on digital objects that artists sell. This way central instances can acquire ultimate control of important objects in our lifes.

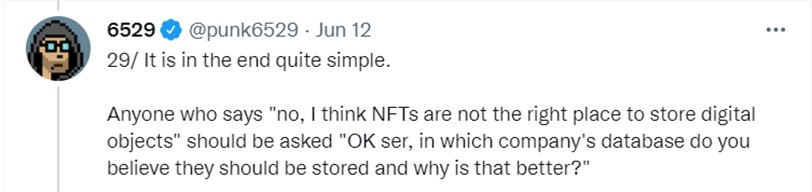

Tweet from pseudonymous Twitter user punk6529.